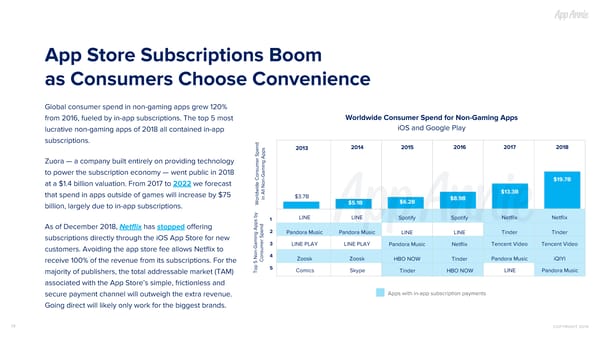

App Store Subscriptions Boom as Consumers Choose Convenience Global consumer spend in non-gaming apps grew 120% Worldwide Consumer Spend for Non-Gaming Apps from 2016, fueled by in-app subscriptions. The top 5 most iOS and Google Play lucrative non-gaming apps of 2018 all contained in-app subscriptions. 2014 2015 2016 2017 2018 2013 Zuora — a company built entirely on providing technology to power the subscription economy — went public in 2018 $19.7B at a $1.4 billion valuation. From 2017 to 2022 we forecast $13.3B that spend in apps outside of games will increase by $75 $3.7B in All Non-Gaming Apps $8.9B $6.2B $5.1B Worldwide Consumer Spend billion, largely due to in-app subscriptions. LINE LINE Netflix Netflix Spotify Spotify 1 As of December 2018, Netflix has stopped offering 2 Pandora Music Pandora Music Tinder Tinder LINE LINE subscriptions directly through the iOS App Store for new 3 LINE PLAY LINE PLAY Tencent Video Tencent Video Pandora Music Netflix customers. Avoiding the app store fee allows Netflix to 4 Zoosk Zoosk Pandora Music iQIYI HBO NOW Tinder Consumer Spend receive 100% of the revenue from its subscriptions. For the 5 Comics Skype LINE Pandora Music Tinder HBO NOW Top 5 Non-Gaming Apps by majority of publishers, the total addressable market (TAM) associated with the App Store’s simple, frictionless and Apps with in-app subscription payments secure payment channel will outweigh the extra revenue. Going direct will likely only work for the biggest brands. 18 COPYRIGHT 2019

The State of Mobile 2019 Page 17 Page 19

The State of Mobile 2019 Page 17 Page 19