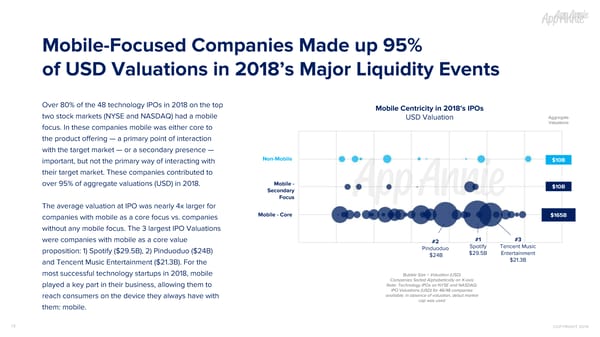

Mobile-Focused Companies Made up 95% of USD Valuations in 2018’s Major Liquidity Events Over 80% of the 48 technology IPOs in 2018 on the top Mobile Centricity in 2018’s IPOs two stock markets (NYSE and NASDAQ) had a mobile Aggregate USD Valuation Valuations focus. In these companies mobile was either core to the product offering — a primary point of interaction with the target market — or a secondary presence — Non-Mobile $10B important, but not the primary way of interacting with their target market. These companies contributed to Mobile - over 95% of aggregate valuations (USD) in 2018. $10B Secondary Focus The average valuation at IPO was nearly 4x larger for Mobile - Core $165B companies with mobile as a core focus vs. companies without any mobile focus. The 3 largest IPO Valuations #1 #3 were companies with mobile as a core value #2 Spotify Tencent Music Pinduoduo proposition: 1) Spotify ($29.5B), 2) Pinduoduo ($24B) $29.5B Entertainment $24B $21.3B and Tencent Music Entertainment ($21.3B). For the most successful technology startups in 2018, mobile Bubble Size = Valuation (USD) Companies Sorted Alphabetically on X-axis Note: Technology IPOs on NYSE and NASDAQ; played a key part in their business, allowing them to IPO Valuations (USD) for 46/48 companies available; in absence of valuation, debut market reach consumers on the device they always have with cap was used them: mobile. 15 COPYRIGHT 2019

The State of Mobile 2019 Page 14 Page 16

The State of Mobile 2019 Page 14 Page 16