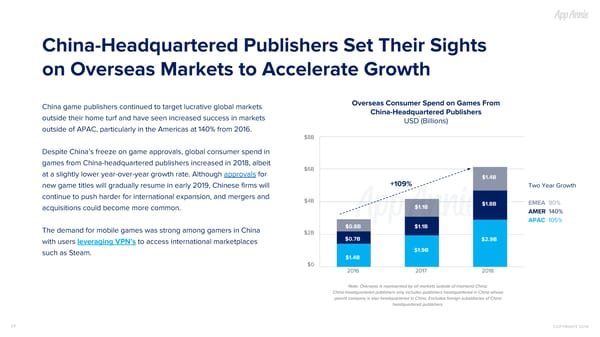

China-Headquartered Publishers Set Their Sights on Overseas Markets to Accelerate Growth Overseas Consumer Spend on Games From China game publishers continued to target lucrative global markets China-Headquartered Publishers outside their home turf and have seen increased success in markets USD (Billions) outside of APAC, particularly in the Americas at 140% from 2016. $8B Despite China’s freeze on game approvals, global consumer spend in games from China-headquartered publishers increased in 2018, albeit $6B at a slightly lower year-over-year growth rate. Although approvals for $1.4B +109% Two Year Growth new game titles will gradually resume in early 2019, Chinese firms will continue to push harder for international expansion, and mergers and $4B EMEA 90% $1.8B $1.1B acquisitions could become more common. AMER 140% APAC 105% $0.8B $1.1B The demand for mobile games was strong among gamers in China $2B $0.7B $2.9B with users leveraging VPN’s to access international marketplaces $1.9B such as Steam. $1.4B $0 2016 2017 2018 Note: Overseas is represented by all markets outside of mainland China; China-headquartered publishers only includes publishers headquartered in China whose parent company is also headquartered in China. Excludes foreign subsidiaries of China headquartered publishers. 24 COPYRIGHT 2019

The State of Mobile 2019 Page 23 Page 25

The State of Mobile 2019 Page 23 Page 25